France, Europe's biggest market for Copernicus

Founded in 2013 in Madrid, Copernicus is an independent group with over 250 employees specialising in the management of portfolios of real estate assets (REOs) and debt (Corporate, SME and Residential Mortgages) secured by real estate assets.

Copernicus manages more than €10 billion in assets. In view of this size, Copernicus remains a small, agile and flexible structure, capable of responding to all market issues, as Jérôme Vallée, CEO of Copernicus France, explains:

Our aim is to assist our investor clients in purchasing portfolios of doubtful bank loans, always including a property asset. We then optimise the purchase to achieve the profitability, productivity and margin expected by the investor. To do this, we have business experts and our own technology.

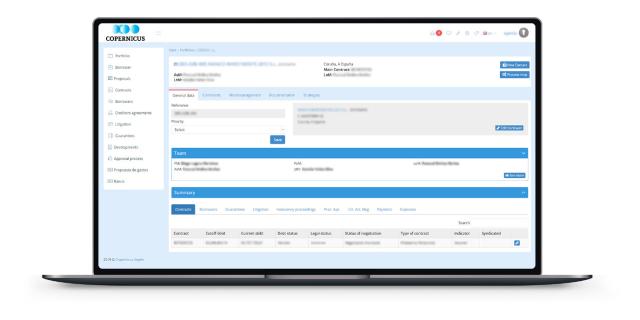

The technology developed by ©Copernicus

The technology developed by ©CopernicusTheir own technology and, more specifically, their own IT tools based on artificial intelligence and machine learning. Around twenty IT specialists develop all the tools in-house.

With operations in Spain, Portugal, Italy, Greece, Peru and now France, the Group’s choice of location depends on the development potential of each market. The French market is the largest in Europe, with more than €120 billion in doubtful debts in bank accounts. So while France is a logical choice of location, the Lille metropolitan area is not to be outdone!

Lille, France's 3rd-largest financial centre

Jérôme Vallée, with 28 years’ professional experience in financial services, has been chosen to head up Copernicus France. For him, the move to the capital of Flanders was an obvious one, for a number of reasons:

- Firstly, for its strategic position at the heart of Europe and its transport network: “We’re close to Paris, Brussels, London and Amsterdam… Lille has excellent rail and air links to all parts of Europe”.

- Lille was also chosen over Paris for economic and practical reasons: “Lille is much cheaper than Paris. When you’re in Paris, you lose a lot of time in public transport when you go to see a client. And Lille is only 1 hour from Paris!

- Lille and its metropolitan area are France’s 3rd largest financial centre, with numerous banks, specialist companies and competitors. “You have all the know-how and human expertise you need in Lille. It’s ideal for recruiting juniors and experts.

- Last but not least, Jérôme Vallée lives in Lille. Marcq-en-Baroeul is a very dynamic town,” he says, “and it has new, friendly premises, which is also important in terms of image.

Debt collection is carried out ethically and with respect for debtors. The aim is to find amicable solutions. The bank has made a loan and is entitled to recover it. But at the same time, we are aware that people can encounter difficulties. The aim is to try to find solutions for both parties. I’m not looking to take sides. I’m looking for solutions that match the expectations and possibilities of both parties. We are responding to a banking need and personal constraints. We all have the right to have difficulties.

Copernicus France will be expanding in 2021 and 2022 with the recruitment of around fifty new staff to complement the existing workforce.